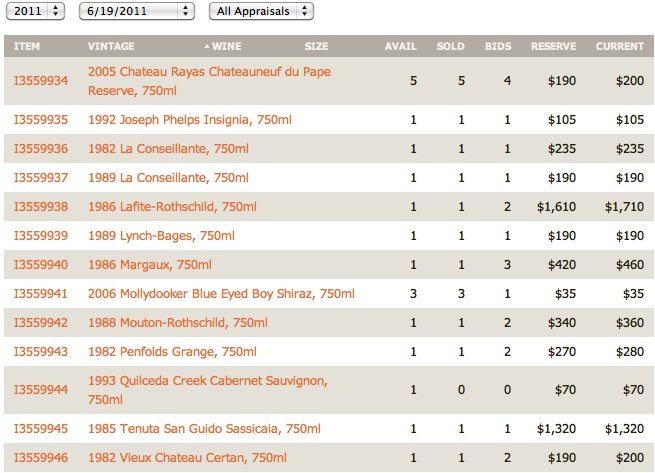

If my first WineBid auction experiment stirred your curiosity, then you will be interested to know the sale closed out successfully with 18 of my 19 consigned bottles selling at, or slightly above, reserve pricing. Only one bottle remains unsold. As suspected, a large slice of bidders and buyers came from Hong Kong and around Asia. As you will read in the following interview with WineBid, there is a high probability some of these international buyers were Asian brokers ready to turn the wines again with deeper markups. The bottles sold for more than $6,000, higher than the agreed upon reserve total for all 19 bottles. Only the remaining 1993 Quilceda Creek has rolled into the new week’s auction. Most importantly, the experience tracked with all expectations WineBid established at the outset.

If my first WineBid auction experiment stirred your curiosity, then you will be interested to know the sale closed out successfully with 18 of my 19 consigned bottles selling at, or slightly above, reserve pricing. Only one bottle remains unsold. As suspected, a large slice of bidders and buyers came from Hong Kong and around Asia. As you will read in the following interview with WineBid, there is a high probability some of these international buyers were Asian brokers ready to turn the wines again with deeper markups. The bottles sold for more than $6,000, higher than the agreed upon reserve total for all 19 bottles. Only the remaining 1993 Quilceda Creek has rolled into the new week’s auction. Most importantly, the experience tracked with all expectations WineBid established at the outset.

I suggest that WineBid’s platform does not really support a week long auction, at least for the kind of wines I consigned. Then again, the lots included some top first growth Bordeaux and besides exotic large formats, what other type of wine could generate week long bidding wars? The sale unfolded more like a “buy now” market, with bids dripping in each day of the week for different wines; usually only one bid per lot. As the auction closed on Sunday, and primarily during the last hour or two, bidding escalated in moderation. Still, you will notice in the summary chart of bids and hammer prices that only a few bottles saw multiple bids. I am confident this bidding profile is the result of WineBid’s algorithms that consistently set reserve pricing at fair hammer levels.

As previously noted, I am a complete amateur at selling fine wine in secondary markets. This sale was my own reflexive protest to insane price escalation on bottles I paid approximately $75 for 25 years ago that are now $1,000+ per bottle drinking decisions. My intention was, and is, to sell a few well-cared-for treasures back to speculators at price points they created and then restock with beautiful wines offering the deepest of pleasure, priced at a fraction of these Bordeaux hammer prices. While parting with these wines made me sentimental and anxious, the outcome validated WineBid as a fair market maker. I am comfortable that all my wines sold at honest buy/sell prices, that WineBid’s seller commission of 18% is reasonable vis-a-vis hammer price predictability, that buyers paying their 15% premium do it on top of reasonable final bids, and that I should have more confidently trusted and embraced WineBid’s East Coast Manager’s claims early in my decision process for selecting a seller.

As previously noted, I am a complete amateur at selling fine wine in secondary markets. This sale was my own reflexive protest to insane price escalation on bottles I paid approximately $75 for 25 years ago that are now $1,000+ per bottle drinking decisions. My intention was, and is, to sell a few well-cared-for treasures back to speculators at price points they created and then restock with beautiful wines offering the deepest of pleasure, priced at a fraction of these Bordeaux hammer prices. While parting with these wines made me sentimental and anxious, the outcome validated WineBid as a fair market maker. I am comfortable that all my wines sold at honest buy/sell prices, that WineBid’s seller commission of 18% is reasonable vis-a-vis hammer price predictability, that buyers paying their 15% premium do it on top of reasonable final bids, and that I should have more confidently trusted and embraced WineBid’s East Coast Manager’s claims early in my decision process for selecting a seller.

Here are some questions and answers that were part of my seller research and showcase my amateurish uneasiness next to WineBid’s experienced confidence:

AJ: I just want to confirm that my total cost is 18% + 1% of hammer price?

WB: Your commission rate, payable to WineBid.com and automatically deducted from each auction’s settlement check, is 18% + 1% insurance of final hammer per auction.

AJ: Will I have to pay for shipping and packing to California and return to another state besides Mass if the wine does not sell?

WB: Our auctions run every week of the year, so what does not sell in one auction automatically rolls into the next auction until the wines sell through. But if you decide to pull wines at any time, you may be subject to a 10% removal penalty and you will have to pay for the return shipping (via carrier and method you have chosen in your registration information) to an address outside of Massachusetts.

AJ: The seller agreement states that WineBid reserves the right to bid on and buy the wine. Can you explain?

WB: Never happens, except for extremely rare circumstances where we autobid due to a reserve error. But in practice…never really happens.

AJ: Quoted reserves could change once the wines are inspected in CA if I choose the automated reserve pricing?

WB: If you choose automated pricing, reserves shift with the system’s default reserves. Reserves rarely shift more than 5% over a two auction period. If you choose custom reserve pricing, the reserves hold for eight weeks without any change, at which point they revert to the system’s default reserves until they sell through. Here is how the system’s default reserve algorithm works…Reserve values are based on past performance of the wine at auction. WineBid.com uses a proprietary algorithm that measures reserves as a weighted average over a six month auction term. Imagine a scale….if a wine sells at the reserve, it adds weight in favor of keeping the reserve at its level. If a wine does not sell in a particular auction, it adds weight toward lowering the reserve. If a wine sells above the reserve it adds weight toward raising the reserve. The higher the value above the reserve, the more weight is added. Eventually, the weight tips the scale in the direction of either raising or lowering the default reserve. In a nutshell, it is strictly market performance based. When a wine has no auction history, it is ranked by vintage, producer, pedigree and sellability against other wines of the same type. The reserve is then set according to what other wines in the category with the same vintage, producer, pedigree and degree of sellabiltiy have as a default reserve.

The data that informs the algorithm is culled not just from our auction, but worldwide auctions and the worldwide market at large. Our pricing database is the most comprehensive and up to date in the industry, full stop. We are constantly catching other retailers, auction houses, etc. trying to crack into our database.

AJ: You try to sell the wine in four consecutive week auctions and then return it….what percentage of your wines go unsold?

WB: No. We sell wines until they sell through. Everything eventually sells.

AJ: What are your buyer premiums?

WB: Irrelevant to the discussion of consignment, but 14% + 1% is the buyer’s premium, which is much lower than other auction houses. As you poll the various auction houses, you will get different quotes on commission rates. Some may be lower than ours, but have higher buyer’s premiums, which discourages bidding. Some may be higher than ours, but have lower buyer’s premiums, which limits consignments. The fact is, all auction houses have different policies based on their philosophy and business model. We play both sides of the equation to provide a balanced format that respects market trends for both the sellers and the buyers. It keeps the final net to seller and buyer within a range that makes sense given the market trends at work.

AJ: Can I withdraw wines after four auctions without penalty?

WB: You may withdraw wines after USING THE SYSTEM’S DEFAULT RESERVES for four auctions.

AJ: When you receive the wines from me, how long until they are placed in their first auction?

WB: No more than three weeks.

AJ: Why use WineBid as opposed to a brick and mortar auction house? I am trying to decide between WineBid and Skinner in Boston.

WB: Well….let me tell you a bit about WineBid.com and how we are different from live auctions and other internet auctions, and you will see where our advantage is over all of our competitors, both internet auctions and live auctions, and also where the costs we absorb are more than our competitors:

- When you consign your wine to any auction, there is always the risk that the hammer price will not be met and the wines will not sell. When this happens, the consignor is put in a compromised negotiating position with the auction houses as to what to do with the goods. With WineBid.com, if the wine does not sell in one auction, it automatically rolls into the next auction, and any necessary subsequent auctions until it sells. This allows our consignors to customize their sales experience. If a consignor has a highly prized cult wine and they would like to see a good profit on it, they have the freedom to set their price and wait for the market to catch up to their price (within reason). After a few auctions, we can steadily roll the price downward until we find the sweet spot that attracts bidding. And while you wait for the wines to sell, you are not charged storage in our state of the art temperature and humidity controlled storage warehouse in Napa. WineBid.com’s auctions run from Monday to Sunday every week of the year, which gives you a never ending string of sales opportunities. No other auction house works within this framework. Another advantage in going with WineBid.com is our customer base. We have over 60,000 registered buyers at WineBid.com, which is over 40% more than anyone else in the trade. Our reach in the market extends from some of the most esteemed collectors in the world to the high-powered brokers and buyers in Asia, to the everyday wine enthusiast in the US. The audience is worldwide, as opposed to the more local nature of many of the other auction houses. Add all of these up and couple it with the fact that our buyers have access to the site 24/7 every day of the year, and the sum is more opportunities for sales than any other auction house, period. With auction grade wine, the potential for fierce bidding competition is exponentially greater because of the greater customer base and access.

- The site itself is maintained by a full time staff of IT professionals who came in as experts on information systems as they relate to internet commerce, and are now experts in the wine auction field. Our site is kept updated as a worldwide market index for wine. Our pricing is based on the actual sales performance of wine not only in our auction, but also in worldwide live and internet auctions. Our staff works around the clock to provide us with the best data in the wine business, not only in pricing, but also with new releases and reviews. As a consignor, you will have access to all of this information via the “seller’s administration” on the site, and also by working with me, your account manager. During the auction, the seller’s administration allows you to view the performance of your collection in real time! What once existed behind a closed door for consignors at auction, is now shared with the consignors with winebid.com. No other auction puts that level of data in the hands of their consignors.

- And then, there are the wine professionals that work for WineBid.com. We have been hand selected by winebid.com’s CEO and other executives for our experience and professionalism. The trust that we have engendered with our consignors and buyers is the cornerstone of our success. This trust has been earned by the high level of professionalism and integrity with which we interact with the wines and the buyers and consignors. Let me give you the breakdown on what happens to the wine once it is delivered to our warehouse and you will see the care and lengths that we go to in order to insure the quality and integrity of every bottle….

- After delivery to the office, the wines are brought to Manhattan Wine Company where they are stored for consolidation with other consignments. Manhattan Wine Company is a brand new top of the line humidity and temperature controlled storage warehouse in Clifton, NJ. Once we have received the wines at Manhattan Wine Company, they are insured under our policy. We have a truck that departs for our Napa facility every other Friday. Our carrier is also temperature and humidity controlled. Once the wines arrive in Napa, they are hand inspected by one of our highly trained, top of the profession inspectors. Once it passes inspection, it is bar-coded, catalogued, inventoried and stocked. Each wine has its own individual slot within our Napa facility (also temperature and humidity controlled). Since shipping and receiving are not really pertinent to our discussion, I won’t go into it here, but since we sell approximately $350 – $500 K per week, you can imagine the scale involved. All computer automated and state of the art. Our logistics personnel are also top of the game.

- None of the storage, shipping, cataloguing and West Coast storage while in auction is charged back to the consignor. There are more advantages to WineBid.com over our competitors, but I think you get the picture.