In early 2006 the Bordeaux price-value line was breached and began its transgression towards complete collapse, erasing all justification for drinking the first growths and other similarly coveted wines that sat in my cellar for decades. Just look at the blue line to the right, representing relative fine wine price escalation compared to the major equities indexes over the same period. My first growth clarets, Sassacaia, Grange Hermitage, “La La’s”…the whole lot…. are now officially fair game on the open wine markets; and isn’t it a shame I will miss tasting those wines? It’s a sad development with a serious silver lining.

In early 2006 the Bordeaux price-value line was breached and began its transgression towards complete collapse, erasing all justification for drinking the first growths and other similarly coveted wines that sat in my cellar for decades. Just look at the blue line to the right, representing relative fine wine price escalation compared to the major equities indexes over the same period. My first growth clarets, Sassacaia, Grange Hermitage, “La La’s”…the whole lot…. are now officially fair game on the open wine markets; and isn’t it a shame I will miss tasting those wines? It’s a sad development with a serious silver lining.

I don’t need the money; that’s not why I am putting these wines out to auction, consignment, and up for private sale. I will reinvest every penny of return in different fine wines. With so much world class wine on the market (both newly released and bottle aged) not being chased by the Chinese nor deemed worthy enough on secondary markets to play into arbitrage investment schemes, is it even remotely possible that $100+ a glass wine can really hold its own in a sensible wine enthusiast’s collecting and drinking strategy?

I swore never to participate in the collection of wine as an investment endeavor, loathing those that treated fine wine as a tradable commodity just to tighten supply chains and run prices skyward for those of us that relish the drinking experience. If you share this sentiment, our only payback is to sell speculators and label crazy luxury market consumers the wines they want at their own rip off prices. In turn, you can own 5-6X more wine than you will sell them without any real sacrifice in total drinking pleasure. I am done telling myself “but wait, you acquired that 1985 Sassacaia for $40 in the late eighties, don’t worry that you can sell it now for close to $2,000 a bottle, just drink it. That 1991 La Landonne you bought for oldest son Alex’s birth year at $100 a bottle is now worth $700 a bottle, but give him the case anyway so he can enjoy it on his wedding day. And that 1986 Lafite Rothschild that you were smart enough to buy on release is now selling for $1,500-$2,000 a bottle was a bargain, so drink away.” It is simply time to unload and reload.

I swore never to participate in the collection of wine as an investment endeavor, loathing those that treated fine wine as a tradable commodity just to tighten supply chains and run prices skyward for those of us that relish the drinking experience. If you share this sentiment, our only payback is to sell speculators and label crazy luxury market consumers the wines they want at their own rip off prices. In turn, you can own 5-6X more wine than you will sell them without any real sacrifice in total drinking pleasure. I am done telling myself “but wait, you acquired that 1985 Sassacaia for $40 in the late eighties, don’t worry that you can sell it now for close to $2,000 a bottle, just drink it. That 1991 La Landonne you bought for oldest son Alex’s birth year at $100 a bottle is now worth $700 a bottle, but give him the case anyway so he can enjoy it on his wedding day. And that 1986 Lafite Rothschild that you were smart enough to buy on release is now selling for $1,500-$2,000 a bottle was a bargain, so drink away.” It is simply time to unload and reload.

Paul Gregutt had a recent piece in the Seattle Times bemoaning that the senseless Bordeaux price inflation focused consumer attention on the category’s unattainable labels and is “muddling the marketability” of producers in relative reach of price/value conscious connoisseurs. It is a sad statement when a region’s best products, the ones that define greatness in Bordeaux, are completely off the table for enthusiastic wine consumers just now entering the market. My advice is to steer clear and find the wines that I will search for to replace the Bordeaux I will sell at unfortunately inflated prices that can no longer be supported by the supreme drinking experiences they represent.

Paul Gregutt had a recent piece in the Seattle Times bemoaning that the senseless Bordeaux price inflation focused consumer attention on the category’s unattainable labels and is “muddling the marketability” of producers in relative reach of price/value conscious connoisseurs. It is a sad statement when a region’s best products, the ones that define greatness in Bordeaux, are completely off the table for enthusiastic wine consumers just now entering the market. My advice is to steer clear and find the wines that I will search for to replace the Bordeaux I will sell at unfortunately inflated prices that can no longer be supported by the supreme drinking experiences they represent.

Just this month I drank 1983 Chave Hermitage that can be purchased for 1/8th the cost of a bottle of 1986 Lafite. The wine was complete magic, full of secondary sweet fruit flavor and aromatics. I carried it from my cellar and opened it in a deserving restaurant, gave the chef and his wife a taste, and they came back to our table whispering that across the room a collector was celebrating a special occasion opening a group of cellar aged, top growth Bordeaux and none of them matched the beauty of the 1983 Chave. I am ready, without even the slightest regret, to exchange a bottle of my Lafite Rothschild for 6-8 bottles of that Chave. Or maybe I will buy 3 bottles of the Chave and a case of the ethereal newly released Clos Rougeard? Who knows, but the world will be my oyster.

Just this month I drank 1983 Chave Hermitage that can be purchased for 1/8th the cost of a bottle of 1986 Lafite. The wine was complete magic, full of secondary sweet fruit flavor and aromatics. I carried it from my cellar and opened it in a deserving restaurant, gave the chef and his wife a taste, and they came back to our table whispering that across the room a collector was celebrating a special occasion opening a group of cellar aged, top growth Bordeaux and none of them matched the beauty of the 1983 Chave. I am ready, without even the slightest regret, to exchange a bottle of my Lafite Rothschild for 6-8 bottles of that Chave. Or maybe I will buy 3 bottles of the Chave and a case of the ethereal newly released Clos Rougeard? Who knows, but the world will be my oyster.

I sent some 1985 Sassacaia to Winebid for appraisal. I bought the wine for $50, it is now worth somewhere between $1200 and $2,000 a bottle. If I can sell even one bottle, it will fund the the entire case of other worldly 2005 Rayas Chateauneuf du Pape Reserve I tasted and acquired last month. Some of my 1982 Penfolds Grange is up for sale as well. If I can sell two bottles that I paid less than $100 each for, I will buy a case of outstanding 2009 Northern Rhones. Why drink one bottle of mind blowing wine when you can repeat the experience 12X at the same price? And my 2004 Latour, a weaker vintage, that I bought on futures for less than $100 is now selling for $500-$600 a bottle. I think I will sell three bottles and replace that with two cases of top Loire Chenin Blancs. I have a lot of work to do, but it will be liberating and completely satisfying.

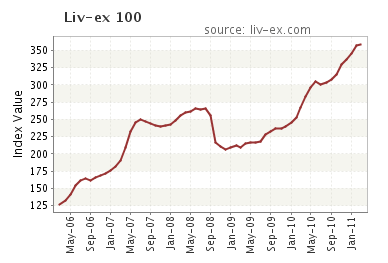

I get a monthly update from Liv-ex on their Fine Wine 100 index. It tracks the price movement of 100 sought after wines on the secondary market. It is a constant reminder of why I don’t buy these wines, how regrettable it is that I can afford them and would like to drink them, but refuse to play the investor’s game when I just want to enjoy drinking them. The trend of unsupportable price escalation continues. The index value stood at 125 in April of 2006 and as of March 31, 2011 it reached 359, up 0.44% on the previous month and 34.26% year over year. Liv-ex has helped contribute to the average connoisseur’s dilemma with their creation and tracking of a secondary trading market. I understand there are collectors and investors that are totally fine with this whole picture. Now, finally, so am I. I think I will use some of the silly money I get back from these less wine appreciative market makers to expand my wine cellar in order to accomodate the new volume of great wine I will cherish drinking.

I get a monthly update from Liv-ex on their Fine Wine 100 index. It tracks the price movement of 100 sought after wines on the secondary market. It is a constant reminder of why I don’t buy these wines, how regrettable it is that I can afford them and would like to drink them, but refuse to play the investor’s game when I just want to enjoy drinking them. The trend of unsupportable price escalation continues. The index value stood at 125 in April of 2006 and as of March 31, 2011 it reached 359, up 0.44% on the previous month and 34.26% year over year. Liv-ex has helped contribute to the average connoisseur’s dilemma with their creation and tracking of a secondary trading market. I understand there are collectors and investors that are totally fine with this whole picture. Now, finally, so am I. I think I will use some of the silly money I get back from these less wine appreciative market makers to expand my wine cellar in order to accomodate the new volume of great wine I will cherish drinking.