Wine is inarguably a vehicle of pleasure to its appreciators. To some others, it is nothing more than a speculative investment vehicle. Acquiring wine without intention to see, touch, nor ever taste it defies any interpretation of the “wine lifestyle” concept. With that perspective and plenty of curious amusement I embraced the week’s news of French authorities green-lighting their country’s first wine investment fund.

Putting aside all intellectual and emotional bias against wine as an investment strategy, the development is laced with incongruity. Partly from its violation of France’s enviable and abiding wine culture, but mostly because of the global investment grade wine market’s continuing decline, the sensibility in French asset management company Uzes Gestion’s decision to launch the their Grands Crus Wine Fund seems marginal at best.

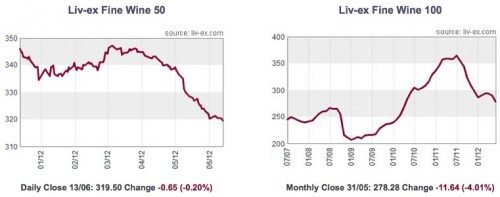

Here is what’s going on with the market according to the Live-Ex index for top traded wine “commodities”:

In addition, the very recent en primeur prices set for 2011 first and second growths declined 30%-45% year-over-year for most Bordeaux producers. While 2011 claret quality is pegged several notches below the previous two vintages, this significant price pressure roots itself in problems extending beyond overall vintage quality. Some reports include sellers price-pandering to their “traditional” consumers in a non-speculative, lower quality vintage not anticipated to garner China’s attention. Even Parker, in his recent 2011 Bordeaux report, urged the Bordelaise to dump at low prices and permit the market to digest more aggressively priced 2009 and 2010 vintages.

There is more at play. Bloomberg recently reported on changes in the secondary wine markets saying, “auction sales indicate Asian collectors are shifting their attention away from Bordeaux first-growths toward less well known clarets and rarer Burgundies, as well as wines from other regions.” Earlier this year Decanter indicated top Bordeaux declined by 22.5% between June and December of 2011 and that “another index, the Live-ex Claret Chip, which consists only of Bordeaux first growths in top vintages going back to the mid-1980s, showed an even steeper decline, dropping 26% in the second half of 2011.” The report went on to substantiate Bloomberg’s conclusion about investor step downs saying “in contrast, top second growths like Leoville-Las-Cases and Cos d’Estournel have outperformed the falling market…Leoville-Las-Cases for example dropped from a high of £2,427 in July 2011 to £2,315 in December 2011.”

Are the Chinese finally developing a modicum of level headed sensibility about quality-to-price ratios at the same time France prepares to spread and institutionalize secondary market speculation inside their own borders? Are Chinese millionaires starting their inevitable abandonment of first growths as business entertainment beverage of choice?

Are the Chinese finally developing a modicum of level headed sensibility about quality-to-price ratios at the same time France prepares to spread and institutionalize secondary market speculation inside their own borders? Are Chinese millionaires starting their inevitable abandonment of first growths as business entertainment beverage of choice?

Where is Thierry Goddet, French wine investment advisor and founder of Cavissima, coming from when he says “wine has become something like a safe-haven investment…With the debt crisis crippling financial markets, we’ve seen new investors flocking in, as they look for defensive investments”? Am I missing something, or do these reports of China starting to settle for Pichon instead of Lafite and the dramatic global Bordeaux wine market swings offer even the tiniest evidence of defensive investing?

How much price manipulation in global commodity markets will it take before level heads realize that consumers suffer at the hands of speculators? Maybe Monsieur Goddet and the Uzes Gestion management team should head to the nearest bistro for a simple glass of Cotes du Rhone and steaming bowls of gratinee Lyonnais to remind themselves what wine really means in France.