I finally caught up with a replay of Rob McMillan’s Silicon Valley Bank (SVB) webinar presentation of their own 2011-2012 State of the Wine Industry report. Rob is founder of SVB’s Wine division. His presentation was not really a state of the wine industry report since the bank and its research are only concerned with the U.S., west coast, fine wine industry. Moving beyond the fact that the report title smacks of US arrogance and an insularity associated with the George Bush presidency, the data is very encouraging if you are a domestic wine producer; price increases, reduced discounts, increasing demand, settled inventories, stable fruit prices, and increasing margins. Here is the summary look:

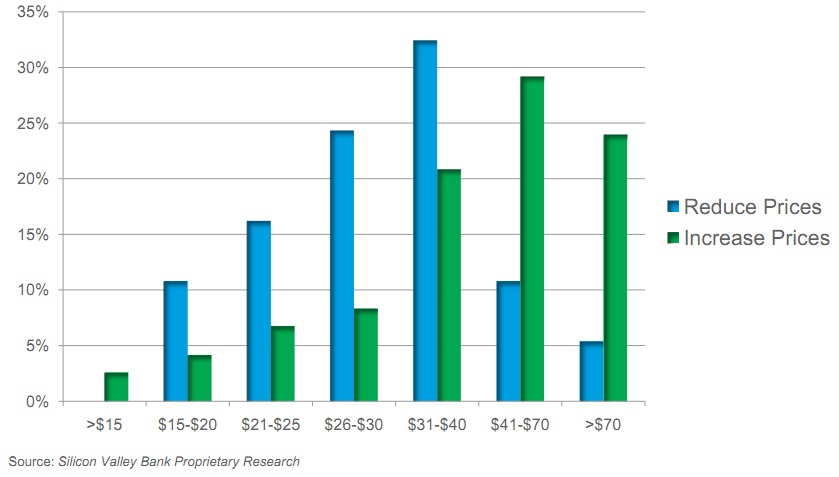

Domestic US wineries lowered prices in 2010 using various allowance and promotional tactics to balance inventory. SVB’s research indicates a bifurcation in the market with anticipated 2011 price increases in the $41+ categories and continued price decreases in the $15-$40 end of the market. SVB points to general spending strength by affluent consumers and the steady unfazed demand in the cult/limited inventory category to support this bullish pricing outlook at the high end.

Domestic US wineries lowered prices in 2010 using various allowance and promotional tactics to balance inventory. SVB’s research indicates a bifurcation in the market with anticipated 2011 price increases in the $41+ categories and continued price decreases in the $15-$40 end of the market. SVB points to general spending strength by affluent consumers and the steady unfazed demand in the cult/limited inventory category to support this bullish pricing outlook at the high end.

But the domestic focus and global arrogance of the SVB report fails to address a core issue that is creating lasting systemic problems for their domestic wine constituency: COMPETITION.

But the domestic focus and global arrogance of the SVB report fails to address a core issue that is creating lasting systemic problems for their domestic wine constituency: COMPETITION.

I just finished looking over Robert Parker’s report on “Top Values” in the 8/31/11 issue #196 of the Wine Advocate. It contains separate lists of American and European value wines, all selling for <$25, that he tasted over the last six months. Parker supplied a preamble and perspective to the lists:

“One thing that has been on a clear upward trajectory over the last three decades has been the increasing number of interesting wines that can be found for under $25, some at remarkably low price points of $8-$15. Such bargains rarely existed years ago, but today they are abundantly available. If you want to prove their value, insert one in a blind tasting against wines made from the same grape or grapes that cost five to ten times more per bottle and see what the results are in your tasting group.” —Robert Parker

With the emergence of smart importers like Eric Solomon, Neal Rosenthal, Louis/Dressner, Terry Theise, and so many others, small winemakers that never dreamed their wines would be discovered outside their villages or countries are now blending exclusively for their importers and the US market. They are selling a lot of this wine for less than $20. Parker did not do a complete job in his report on the international value list since the wines were limited to Europe and primarily two importers; David Shiverick and Peter Weygandt. Still, the report tells a story that the US wine industry needs to come to grips with:

Of the 78 domestic wines reviewed by Parker, 13 (15%) scored 89 points or higher

Of the 90 international wines reviewed by Parker, 51 (56%) scored 89 points or higher

While Parker’s report is not scientific nor conclusive, it is completely reflective of what savvy wine drinkers have discovered; the US industry has done a poor job producing quality value wine while importers have flooded the US market with once undiscovered high quality value European wines. SVB says the ongoing price pressures at the low end of the market is symptomatic of ongoing economic woes of the category’s target consumers. SVB points out the current irrelevance of the over-hyped millennial generation that plays mostly at this lower market level, and urges the fine wine market to refocus on boomer and Gen-X consumers who are more prone to purchase at the higher end of the market.

As long as California and Washington fail to produce authentic quality wines in the $10-$20 category there will be price and inventory problems. The bank ought to advise their clients this way. Of course, it’s not their job to tell their clients how to make their wine. Even if it was, how would a bank that only operates in a slice of the US market and refers to their report as the “State of the Wine Industry” be able to comprehend the global impact on the health of the California wine industry? I have not found a sub $20 California wine that I would prefer over equally priced wine from Cotes du Rhone, Muscadet, Vouvray, Bierzo, Languedoc, Beaujolais, Provence, Friuli, Suditrol, and elsewhere. SVB should stick that opinion in their reports.

Overhead, market structure, and farming economics attached to West Coast winemaking appear to get in the way of low cost/high quality wine success. The idea that failure in the low end can be offset at the market’s top end with continued growth and price escalation appears unsustainable. Runaway Cabernet prices since the mid 90’s took me out of the domestic market as I refocused on higher quality, more attractively priced international luxury wines. The US wine industry needs to admit their failure in the quality value market segment and start figuring their way out of that before they price their golden geese to unsustainable levels.