I always buy wine with an intention to drink it….someday. For me, enjoying wine requires popped corks. Unlike paintings, sculpture, or antiques that can be enjoyed without harming value appreciation or resale opportunities, wine is a consumable whose value remains elusive until it swirls in a glass under nose, eliminating any possibility for future valuation. Not intending to toss stones at the appreciative wine lover unopposed to five and six figure spending at auction or some other secondary market source to access vintages they yearn to drink today, investors doing their own bidding with a profit-only end game ought to leave us all alone and go find more traditional investment instruments.

I always buy wine with an intention to drink it….someday. For me, enjoying wine requires popped corks. Unlike paintings, sculpture, or antiques that can be enjoyed without harming value appreciation or resale opportunities, wine is a consumable whose value remains elusive until it swirls in a glass under nose, eliminating any possibility for future valuation. Not intending to toss stones at the appreciative wine lover unopposed to five and six figure spending at auction or some other secondary market source to access vintages they yearn to drink today, investors doing their own bidding with a profit-only end game ought to leave us all alone and go find more traditional investment instruments.

For some, great wines are nothing more than appreciable liquid (no pun intended) assets, redeemable at market rates through various exchanges and channels. For me, this investment mentality is akin to scratching fingernails across a full length chalkboard. Taking a fixed production artistic beverage and limiting availability to enthusiasts while driving prices skyward in secondary trading markets irritates me. These channels and their investor clients help make our country’s antiquated three tier wine and spirits distribution system appear innocent despite its own highly criticized contribution to restricted competition, suppressed free trade, and limited availability that simultaneously and artificially drives price (see H.R. 5034).

And if it is a mystery how prevalent or alluring wine investing can be, you just need to visit Live-ex:

The London International Vintners Exchange (Liv-ex) is the leading exchange for fine wine. Founded in 1999, Liv-ex runs an internet and phone based information, trading and settlement platform for fine wine merchants. [They] also provide valuation services and sell data to both professional traders and wine collectors.

The Liv-ex membership has expanded rapidly to include the world’s major trade buyers and sellers, including merchants, brokers, retailers, importers, exporters and wine funds.

The exchange is regulated by the membership committee, which is made up of elected members of the trade and Liv-ex management. The committee sets and polices the exchange’s rules. Every trade on liv-ex is governed by a pre-agreed trading contract and buyers are underwritten by credit insurance.

The bulk of Liv-ex transactions are in the best French labels from Bordeaux, Burgundy, Champagne and the Rhone, but not exclusively so. The best names from Italy, Germany, Spain, Portugal and the New World are also traded.

Not so coincidentally, I collect, drink, and learn about wine in phases and stages. My older wine stocks primarily span Bordeaux, Rhone, and California Cabernet. I no longer buy California Cabernet for reasons of style, and mostly price. Because of price, I have restricted recent purchases of Bordeaux and Rhone, focusing only on top vintages en primeur or value vintages and Chateaus. My sensibility around quality, value, and under manipulated honest wines that emit native characteristics are driving me to taste and learn the inner secrets of the Loire Valley, the Mosel, Beaujolais, and far reaching parts of Spain like Ribera Sacra, for example. But, why are these wines on my radar screen only now when my wine journey kicked off back in 1986? Here is one big reason:

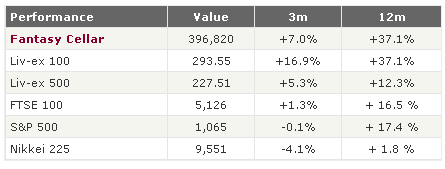

The index, comprised of the most desirable wines that I acquired without too much financial strain twenty five years ago, has increased 300% over the last five years. Services like this which sell wine only to licensed merchants and financial data to those merchants’ investor clients, fuel the froth that consolidates these wines in the hands of those that use wine to balance their investment portfolios. Wine bottles, indices, and funds are equalized to facilitate direct comparison to other investment vehicles, like securities:

The index, comprised of the most desirable wines that I acquired without too much financial strain twenty five years ago, has increased 300% over the last five years. Services like this which sell wine only to licensed merchants and financial data to those merchants’ investor clients, fuel the froth that consolidates these wines in the hands of those that use wine to balance their investment portfolios. Wine bottles, indices, and funds are equalized to facilitate direct comparison to other investment vehicles, like securities:

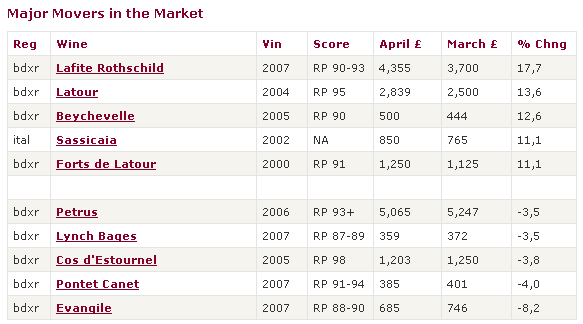

And wine, like securities, can be ranked by best and worst performance too. None of this sounds like the terms of original intent conjured up by their producers, but instead like investor-speak ranking data:

And wine, like securities, can be ranked by best and worst performance too. None of this sounds like the terms of original intent conjured up by their producers, but instead like investor-speak ranking data:

Recently, a really good man I occasionally drink wine with and who reached out for my help 15 years ago to get his wine cellar started, sent me this email after receiving an invitation to consider wine as an investment instrument:

Adam,

[A friend sent this to me and it] intrigues me… Have you ever looked at an investment vehicle like this?I am going to ask for more info and attend the meeting, your thoughts?:….see attached info for detailed info on a new private equity fund I came across that is in the process of forming for the purpose of selectively investing in investment grade wine, i.e. wine with a long and proven track record of appreciating with time. I am planning to be meet with these folks in the coming weeks to discuss in more detail for my own purposes.

As some of you know earlier this year I started a small side business, for the purpose of purchasing Investment Grade Wine (IGW) in the pre-release market and later selling it for a profit when the market dictates (likely 5-7 years later seems to be the sweet spot). I started research for this venture because of a very positive experience I had purchasing 2000 Bordeaux futures (in 2001 or so) and then selling this wine at auction 6-8 years later. I did not buy any of it with the intent of selling, by the way, but as I saw the appreciation of 50% to 500%, depending on the producer, it became an easy call.

I came across a group out of CT called “ABC Wine Fund (name changed in order to not promote them in this post: WZ)”. I have since had several very interesting conversations with one of their principals and thought some of you might also be interested. The “ABC Wine Fund” is basically doing exactly what I am doing with my LLC to take advantage of the very attractive economics of IGW, so why I am looking at them? They are obviously more sophisticated than my side gig, but so what – I don’t have to be a private equity fund to make money on this. Most interestingly, the “ABC Wine Fund” has significant advantages on both the front end (buy) and back end (sell) compared to my venture. On the buy side they have relationships in France which are 2-3 levels closer to the Chateau than what I purchase at, resulting in purchase costs 30-50% lower than the best I can buy at…. On the sell side, the “ABC Wine Fund” has secured licenses in all 50 states….giving them an ability to capture probably 2/3rd’s of the 30+% a seller loses when selling at auction, as there is typically a 10% sellers fee and 20% buyers premium paid to the auction house….

While all of this is legal, it smacks of back alley dealings, deals that provide high returns that you never want to see your name attached to in the media. These funds and investors deal in some of the prettiest wines made, and instead of folks like me buying on release or en primeur at reasonable prices, wine-unappreciative investors create demand that inflates price for us that only want to drink the wine the way it was intended to be enjoyed. One man’s profit becomes another man’s nemesis. There is a place for these secondary markets for wine collectors with excess inventory or financial need, and for the wine enthusiast seeking a special case or two. If it is ok to malign critics and their 90 point scores for driving price, and to eviscerate the intentions of wholesalers and distributors behind legislation like H.R. 5034, then why not profit greedy investors? Clearly, wine for investment-only purposes complicates an already awkward distribution and valuation process that requires navigation expertise by the dedicated wine consumer. For my part, I would like to see it all end. What about you?